If you recently paid for a service by swiping your card through someone’s iPhone or you paid for your parking meter by using your phone, you probably experienced a moment where you realized that the 21st century is here and life as we have known it is growing more and more to be like the Jetson’s space age cartoon we watched as kids. No one can tell the future, but here are some things to look for as our modes of payment, our concept of cash and our physical world goes ever digital.

More choices for mobile payment vendors

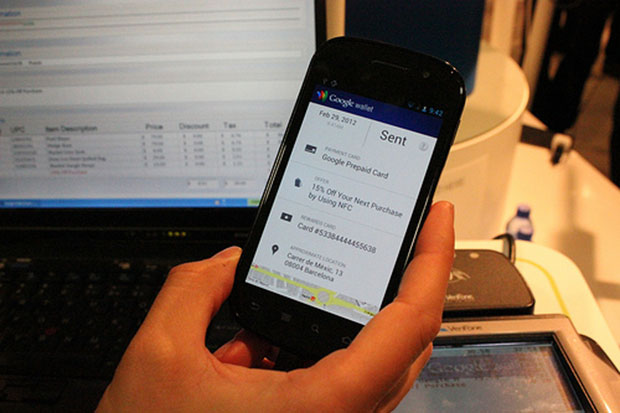

Last year PayPal was feeling the heat as Square and several other mobile payment systems surfaced to compete. Square, Google Wallet, Isis and LevelUp are all new mobile systems that are competing to give vendors the best most flexible payment systems to offer their clients.

Smartphone in place of a wallet

Technology trend analysts say that even cold hard cash is going to become a thing of the past. Instead, your smartphone will have apps and other various payment options that will substitute for credit cards and cash. No more clunky handbags or uncomfortable sitting on that back pocket wallet. Your phone is going to do more than ever sooner than you think. Several app developers have been trying to develop an app to operate as a mobile wallet, but the problem is no one app is going to be able to ‘win.’ Consumers have different needs and they want choices. The bottom line will be accessibility and how fast merchants get on board with accepting these apps. Once customers begin to pay with their phones, the chances of credit card fraud will also be significantly reduced. Smartphones offer more authentication abilities such as passwords, location pinpoints, and QR codes.

Better connections between online and brick-and-mortar stores

In the past few years with the rise of online merchants who are able to undersell local merchants, local businesses have suffered. Consumers check out products at the store and then order them from a larger company online where they can get more specs, check out the competition and sometimes get price breaks. In the future, product companies can catalog their products and offer many of those points of information online. They can also connect the SKU number to the merchants in town who are selling the product. This way the process can get reversed and consumers can support their local economies while still taking advantage of digital information.

EMV credit cards

According to technology analysts the magnetic stripe credit card is becoming an archaic technology. Chip-and-Pin credit cards are becoming the better choice because of its security. The chip produces an original code for every single purchase, which makes it a lot easier to catch fraud. For some reason, many countries have already wholeheartedly embraced this upgrade, while the United States lags behind on the shift.

Changing the way we pay may not seem like a big deal, but it affects the way consumers shop on a significant level. If your business wants to keep up with consumer needs and desires, it’s crucial to keep up with the right payment systems and to allow the kind of flexibility that the digital world will have consumers taking for granted.

Tony Alvarez writes for Merchant Maverick, where you can find credit card processors, comparison charts, as well as processor reviews for companies such as First American Payment Systems.

What's in Store for Mobile Payment Systems,